Rick responded to “The Tax Agreement: Another Victory For The Party In Power — The Money Party” with this comment: “Gentlemen, approximately 50% of wage earners pay no income tax. Does that bother you? It bothers me.”

Rick is bothered that 50% of wage earners pay no income tax — but, what is bothersome is the fact that the reason so many wage earners are not required to pay income tax is because they have little income.

We should all be bothered enough to attempt an answer to this question: How should a wealthy nation, with a representational democracy form of government, respond to this fact that many of its citizens have insufficient income, while a few of its citizens have enormous income?

It makes sense, to me, that one purpose of our tax system should be to bring more income fairness to the average person, that one purpose of our tax system should be to redistribute wealth. If not through the tax system, then how?

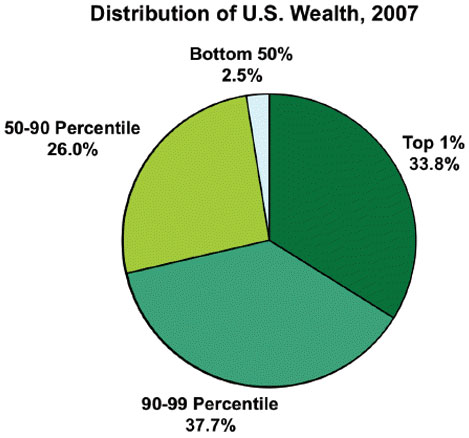

Timothy Noah of Slate reports, “The richest 1 percent account for 35 percent of the nation’s net worth; subtract housing, and their share rises to 43 percent. The richest 20 percent (or “top quintile”) account for 85 percent; subtract housing and their share rises to 93 percent.” Noah cites a Harvard study that shows most Americans are unaware of the enormity of this income inequality. But income inequality is a huge and growing issue in our democracy and should be a matter of in-depth discussion and analysis.

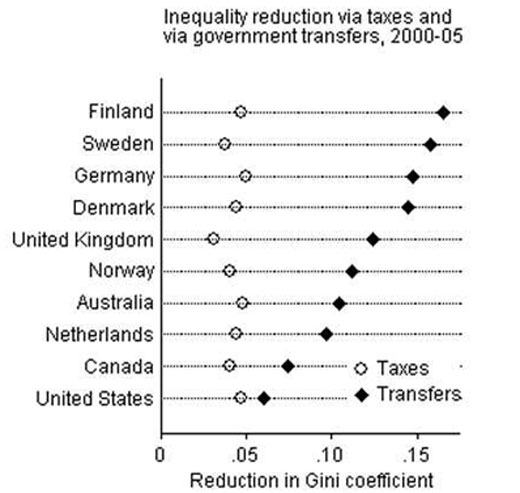

Here is a chart that shows that the U.S., in comparison with other countries, does a poor job of wealth redistribution:

Here is a pie chart that shows how wealth is distributed in the U.S.

Here is a pie chart that shows how wealth is distributed in the U.S.

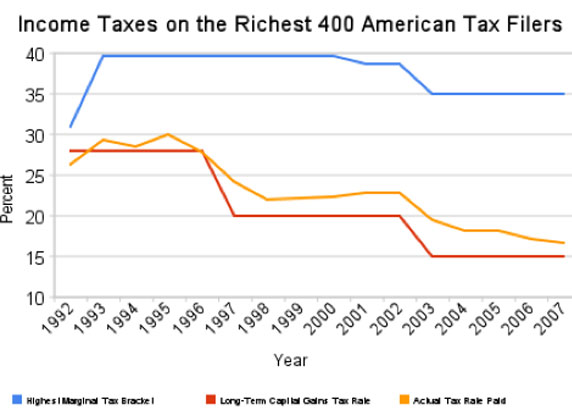

Americans who are wealthiest pay a lower percentage of their income to income tax than Americans who have modest means. The blue line is the highest marginal rate, but the rate most wealthy pay (the orange line) is a much lower rate -- close to the rate for capital gains (the red line).

Robert Feinman has a web-site that analyzes the issue of wealth redistribution for America. Here is his conclusion:

Conclusion: History has shown that when societies get too unequal bad things happen. They either become economically inefficient or they become subject to social unrest. In many cases both happen simultaneously. The banana republics of South and Central America are a good example. For hundreds of years a small ruling oligarchy has run things. Things are even pretty good for these people. However, the societies as a whole have not prospered. They have been subject to continual poverty and revolution and much of the development that has taken place is in the hands of foreign investors. The wealth of the few has been maintained at a high cost to the majority.

As new societies arise which are more equal and more efficient, the oligarchical societies will fall ever further behind. The peasant class that kept things going, inefficiently, will no longer be enough. The capital needed for growth will not be present and the expertise needed to deal with modern technology will not be in place. We can see such failed societies in parts of Africa.

We in the US need to decide if we are going to slip into an inefficient oligarchy, risk civil unrest or redirect our resources and wealth into more equitable avenues. No society is perfectly egalitarian, but when we have reached a point where the top one fifth in Manhattan makes $350,000 and the bottom fifth makes $7,000 we are probably near an economic tipping point. How we deal with the coming challenge is up to us.

Moral: A just society is an equitable society, an equitable society is a just society.

Sounds good. Most Americans don’t agree. The wealthy have more solidarity than ordinary people. Businesses almost universally oppose the kind of regulation that would increase fairness in the marketplace. Ordinary people don’t have that much solidarity with each other, are as likely to criticize as stand with, and seem to prefer identifying with the wealthy and hoping they might get there someday than making things better for everyone. Many feel there isn’t enough for everyone so you need to make sure that you are one of the winners by whatever means are required. Perhaps this is partially because the media, which that functions as the community square shaping viewpoints in today’s society, is controlled by the wealthy. Some of it may be a legacy of the cold war and how that made capitalism and its excesses patriotic and criticism of them treasonous. Many may feel that modern surveillance, police and prisons make civil disturbances unlikely or have learned to live or away from with the consequences of inequality, which are as likely to be depression, substance abuse and the low intensity violence of domestic violence, gangs and prisons. Some say that there is more fellow feeling and willingness to support social safety nets when people have more in common and there is less diversity, as in Scandanavian countries. The astounding ability of Obama’s opponents to convince substantial segments of the population that Obama, both a success story from modest origins and a moderate establishment figure in his governance, is a radical Marxist is pretty amazing.

Mike,

I have to call BS on this whole article.

Again, I believe you are focusing too much on equitable results (income) and not enough on equitable opportunities. The US was called the ‘land of opportunity’ for a reason. It was, and to a great extent still is, a place where you are free to succeed and free to fail(bailouts are another story) — where it didn’t matter what level of society you were born into or what your last name was — where you were free to set your own destiny through hard work and determination.

One line in your article that particularly bothered me was this: “Here is a chart that shows that the U.S., in comparison with other countries, does a poor job of wealth redistribution”

Let me rephrase it from a fundamentally different angle. “Here is a chart that shows that the U.S., in comparison with other countries, does a good job of rewarding hard word, encouraging innovation, and provides incentives to be successful.”

Getting back to Rick’s comment that inspired this post, I too am troubled that almost 50% of citizens do not pay taxes. We are approaching a point where a majority can essentially vote to take away money from one group of people and give it to themselves, more so than is currently being done. (Could that be the societal tipping point of civil unrest?)

I dislike taxes as much of the next guy, but will admit that they do serve a variety of legitimate interests. But is it really legitimate to use the rule of law to take from one and give to another? I’m all for charity, but is that really charity?

Most people I tell this to think I’m exaggerating, but with my line of work, I often personally see the many income redistributive programs. Here are the ones I know of: Unemployment being used as a way of life instead of a bridge, disability or soc. Sec. for a senior being used to live off of by the next two younger generations (often in the same house), earned income tax credit, food stamps and WIC for food, subsidized heat bills, discounted electric bills, subsidized housing (section 8), free landline phones & cell phones, Medicare/healthcare, and a number of others. Because of these programs, there are many people in the area ‘living large’ working at McDonalds part time content to save up their money for a big screen TV and some alcohol.

What I see is a growing segment of the population that is learning to and content to live off of the hard work of others, losing all desire to work for something or even attempting to succeed and be self reliant. Ever been to a national park? The reason they tell you not to feed the animals is because they quickly learn that tourists are now a source of food, lose their instincts to hunt for their own food, and become a danger.

I’ll back you on a number of things when it comes to increasing opportunities and treating one group of people the same as another. However, when it comes to a more redistributive tax system, I believe you couldn’t be further off base.

The IRS is accepting comments on how to simplify the tax code and make it fairer to everyone. http://www.taxpayeradvocate.irs.gov/Home/Contact-Us

Some ideas I support, even though I will take a hit and pay more, include getting rid of all the special interest exemptions and get back to treating everyone the same. What would I phase out? Mortgage interest deduction, student loan interest deduction, earned income tax credit, teacher supply credit, energy tax credits, and many other above and below the line deductions and credits. Of course that would just be the start…

bryan you are very lost young mind. There is no such thing as equal opportunities when a poor person starts out life with in most cases low self-esteem, low paying job, no savings, poor education and other issues. Poor communities don’t teach their kids the required skills needed to compete in the US. — look at state report cards, man. I did. So the statement. of course we are free to succeed or fail. But once you take a couple of courses in psychology and sociology you will understand that a peoples’ environments dictates their behaviors. No matter what.

It’s just not true whatsoever that 50% of wage earners don’t pay income tax. Any single person who makes over around $14,000 will no doubt pay fed and state tax. Almost everyone who works pays local tax. local tax is income tax. so the whole statement is false anyway. Basically the new minimum wage at full time rate puts any single person paying income taxes.

Your example of unemployment insurance is horrible. That program is paid for through businesses. soc and medicare medicaid is taken out of every single working person in the U.S., including minors, so leave that out because we all paid for those services and we should use them. You are right on the big screen tv’s. people who work at Mcdonalds part-time are broke as heck. They don’t have crap. Nothing. So if you hand them $100, they will immediately buy something. So its makes common sense that if u want to stimulate growth, GIVE IT TO POOR PEOPLE. It’s a direct economic stimulus. If we give it to rich people they will stick it in the bank and nobody will see it. Take a couple of economic classes and you will know that. I DID.

Sadly enough, though, I agree totally with you, but I also know that no matter what happens there will always be the poor. There just needs to be more rules added to the whole food stamp section 8 programs. I know that a person making $12,000 a year can’t buy jack. So the gov will give them $120 in food stamps in certain counties, but the county pays some of that which comes from sales tax which everyone pays. So I hope people don’t argue with paying for something and using it when you need or want it. That’s why we pay for stuff. To use it. But for the people who don’t pay federal or state tax. You are somewhat correct. That is a problem. They need to become wage earners and pay taxes. But also there is a lot of work we have to do as a country to make that a reality.

We cannot be the richest country in the world and act like we struggling over foodstamps and section 8. Those are not the problems. Fica is what they call it. The tax everyone pays should pay for all those medicare soc crap u talk about. Military expense is out of control. There is where we need to cut. Wasting dollars to move jobs from one state to another. Not only is the dumbest idea I ever seen but it waste billions. It waste more than 20 million in Dayton area alone. Billions on a state level. If we could just make a law that no state, county or city could give any tax abatements or grants to any businesses for economic development. We could stop the wasteful spending of billions just to move 2000 jobs from one state to another. All that is doing is creating a hole where they fill one elsewhere. Economic development should be left to the fed gov.

Lastly I totally disagree with your cuts. All you want to do is cut stuff from people who make our country work. OUR country started with hard working people. NOT BUSINESSES. That’s why we are struggling. A company should not have more rights than the people. Hard working people is what makes our country good, not companies. IF U want it all equal, make all companies pay at their tax rate. NO deductions. Then we will look at individuals.