I attended the Montgomery County Democratic Party’s annual rally / fund raiser last night at the Dayton Convention Center. Ted Strickland was the special speaker.

Strickland looked fit and trim. He gave a rousing speech that responded to Ohio’s SB5 — landmark legislation that curtails the bargaining rights of public employees that Governor Kasich had signed earlier in the day.

I wish I would have taken my video camera. The videographer recording the event, I hope, eventually will post the speech — and if so, I will link to it. I took notes as best as I could — and below are some of the key sentences and phrases from Strickland’s speech that I noted.

- SB5 is the most mean spirited, antifamily legislation ever passed.

- We are facing the greatest threat to middle class since the days of Franklin Roosevelt.

- Conservative and libertarian think tanks have been plotting for years and are mounting a united effort in Ohio, Wisconsin, Indiana, Michigan.

- If they can break organized labor, there will be no restraint on corporate control of everything.

- They think they are winning, but people have had their eyes opened. The radical right has taken off its mask and now everyone can see the ugliness they have been hiding.

- Kasich’s plan attacks public education and will deprive public education of $3.1 billion over the next two years.

- What they (the radical right) really want to do is to repeal the New Deal and in so doing decimate the middle class.

- If ever you have been willing to fight, determine to fight now.

- Our values and principals are are risk. Our country is at risk. This is a political Armageddon and we must win.

I took a lot of pictures, but, didn’t know how to use the camera I borrowed — I’m looking for a new one — and so most of the pictures I took didn’t come out. But here are a few:

County Treasurer Caroline Rice

County Treasurer Caroline Rice

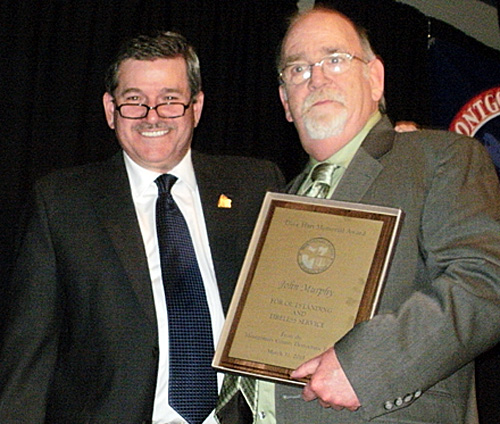

John Murphy, President of our South of Dayton Democratic Club, received a special award. Here he is with his daughter, Gen, who is also the administrator of the MCDP headquarters.

Me and Ted -- We both graduated from Asbury College -- separated by a number of years. You wouldn't know by this picture, but this youthful looking former governor is eight years older.

County Auditor Karl Keith did a great job as "Master of Ceremonies." Here, shown congratulating President Murphy.