The distribution of wealth in our society is becoming ever more disproportionally distributed. A new report released the Congressional Budget Office shows that changes in government policies has caused an even bigger proportion of new income to be distributed to the already wealthy.

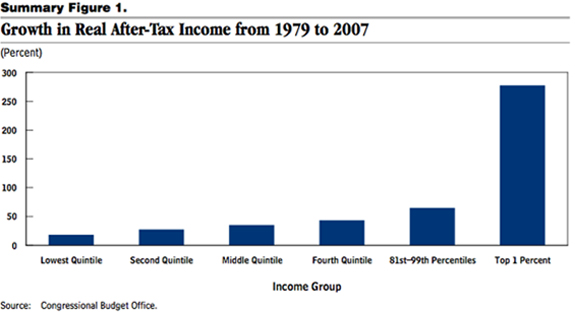

The report — “Trends in the Distribution of Household Income Between 1979 and 2007” — gives the good news is that 1979 to 2007 the income of American households, on average, adjusted for inflation increased by 62%. It shows some interesting graphs as to how this new wealth has been divided:

The graph (above) shows that the top 1% of income earners saw their incomes increase by 275%. The bulk of income earners — the 60% in the middle — saw increases of about 40%. and the lowest incomes saw increases of only 18%

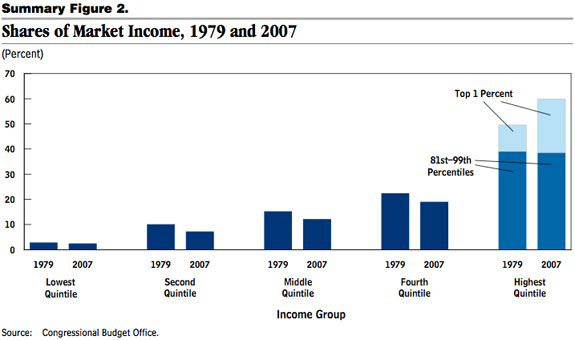

Market share (figure 2 above) is defined as “income measured before government transfers and taxes” and those already wealthy had the biggest increases in market share. The highest income quintile’s share of market income increased from 50 percent to 60 percent. The change in the top 1% was the most dramatic, more than doubling — from 10% to 20%.

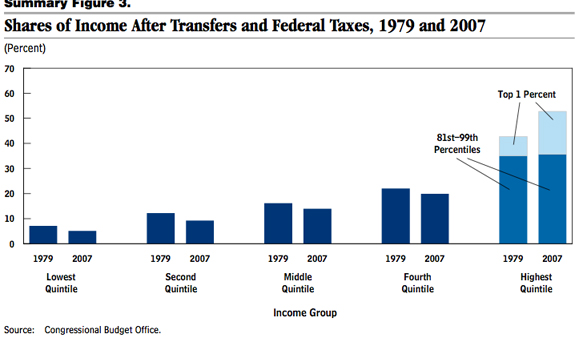

This third chart shows that government policies was a major reason why the big increases in wealth were distributed to favor the wealthy.

“Although an increasing concentration of market income was the primary force behind growing inequality in the distribution of after-tax household income, shifts in government transfers (cash payments to individuals and estimates of the value of in-kind benefits) and federal taxes also contributed to that increase in inequality.” …

The size of transfer payments — as measured in the study — rose by a small amount between 1979 and 2007. The distribution of transfers shifted, however, moving away from households in the lower part of the income scale. In 1979, households in the bottom quintile received more than 50 percent of transfer payments. In 2007, similar households received about 35 percent of transfers.

Likewise, the equalizing effect of federal taxes depends on both the amount of federal taxes relative to income (the average tax rate) and the distribution of taxes among households at different income levels. Over the 1979– 2007 period, the overall average federal tax rate fell by a small amount, the composition of federal revenues shifted away from progressive income taxes to less progressive payroll taxes, and income taxes became slightly more concentrated at the higher end of the income scale. The effect of the first two factors outweighed the effect of the third, reducing the extent to which taxes lessened the dispersion of household income.

As a result of those changes, the share of household income after transfers and federal taxes going to the highest income quintile grew from 43 percent in 1979 to 53 percent in 2007 (see Summary Figure 3). The share of after-tax household income for the 1 percent of the population with the highest income more than doubled, climbing from nearly 8 percent in 1979 to 17 percent in 2007.

The population in the lowest income quintile received about 7 percent of after-tax income in 1979; by 2007, their share of after-tax income had fallen to about 5 percent. The middle three income quintiles all saw their shares of after-tax income decline by 2 to 3 percentage points between 1979 and 2007.